NEAR Protocol is a smart contract platform, which focuses on developer and user-friendliness. It provides a scalable platform for running applications. NEAR was founded in the summer of 2018 by Alex Skidanov and Illia Polosukhin. Today, in this article, we will be looking at DeFi applications on the NEAR Protocol.

The Rise Of DeFi

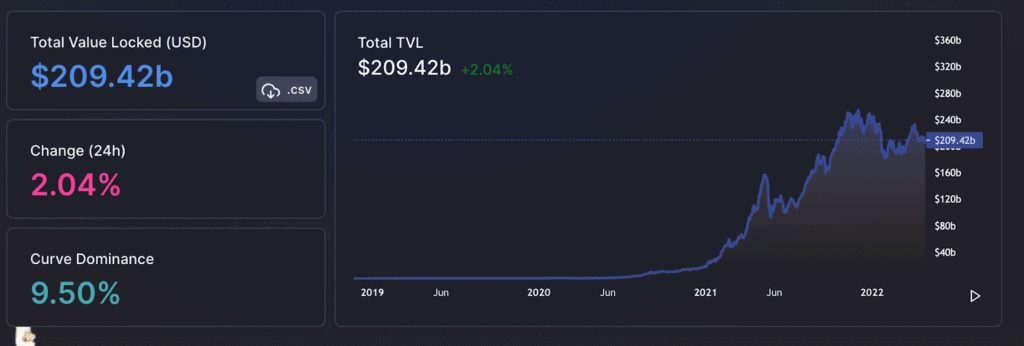

DeFi or Decentralized Finance are blockchain-based financial instruments. While centralized financial instruments are bogged down by lack of interoperability and red tape, DeFi apps are like Lego blocks that users can join together to create new instruments. As a result, the DeFi ecosystem has ballooned from $7.40 billion on June 22, 2020, to $250 billion on December 1, 2021. That’s a 3278%% rise in value in a little over a year!

As of now, the total value locked up in DeFi is around $209.42 billion.

The True Significance Of DeFi

Just talking about total value locked isn’t enough to understand the true significance of DeFi. It is a crucial element in building the Open Web and has been single handedly responsible for the influx of talent that Ethereum has experienced over the last two years. If you think about it, this makes absolute sense due to the revolutionary and composable nature of DeFi. Actions that could take weeks in the traditional finance world now take just seconds.

However, there is a flip side to this equation as well. Due to the spike in demand, DeFi has been responsible for causing network congestion and rising gas prices. As such, the barrier to entry for Ethereum has become significantly higher for newbie developers and creators.

NEAR Protocol provides a viable, faster, and cheaper alternative to Ethereum.

DeFi On NEAR Protocol

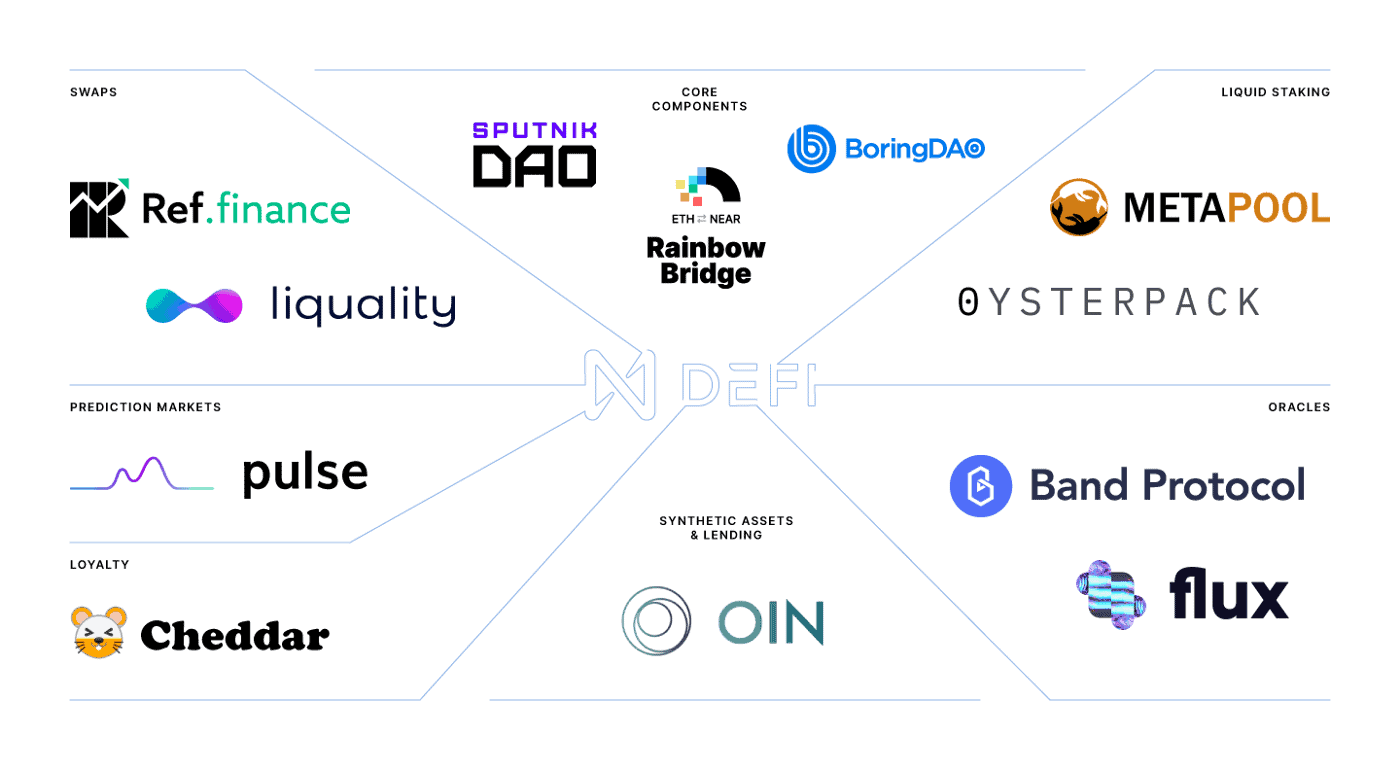

Let’s go through some of the most promising DeFi projects on NEAR.

Rainbow Bridge

The Rainbow Bridge exists between NEAR and Ethereum. All assets originating on Ethereum are now completely usable in NEAR. Since its launch, over $1 million worth of ETH, DAI, and other tokens have crossed the bridge. The Bridge infrastructure can be easily repurposed and ensure connections between NEAR and all EVM-compatible chains, like Polygon, BSC, Avalanche, Optimism, Arbitrum, etc. The team is currently working to extend this infrastructure to support non-EVM chains like Bitcoin, Cosmos, etc.

Here are some things you need to know about the Rainbow Bridge:

- Users can be onboarded to Rainbow Bridge directly through MetaMask.

- NEAR transactions get confirmed in under 2 seconds costs <1 cent in gas fees.

Here is what a NEAR<>Ethereum bridge transaction looks like:

- Assets going from Ethereum to NEAR take about 6 mins (around 20 blocks).

- ERC20 transactions cost about $10 on average.

- Sending assets from NEAR back to Ethereum takes a maximum of 16 hours (due to Ethereum finality times). This process also costs around $60 due to ETH gas costs.

The Rainbow Bridge is an important innovation since it’s an essential first step in NEAR’s interoperability roadmap. Furthermore, since NEAR offers faster and cheaper transactions, it may be favorable for users of other chains to interact with Ethereum assets on NEAR rather than bridging directly to Ethereum.

Ref Finance

Ref Finance was the first DeFi platform on NEAR. The first version of Ref had some similarities with Uniswap V2, along with support for more pool types, configurable fees, and it is entirely community-owned. Its main aim is to bring together core components of DeFi like decentralized exchange (DEX), lending protocol, synthetic asset issuer, etc.

Ref Finance has a treasury of 35 million $REF of which 10% is allocated to a development fun for upcoming projects and 25% for future community-related activities, events, and partnerships.

Features of Ref Finance

- Ref’s AMM DEX allows permissionless and automated trading between any native NEAR or bridged token.

- Liquidity providers can earn $REF or NEP-141 tokens by staking LP tokens.

- Users can stake $REF tokens to earn more $REF over time.

Ref is a community project and is maintained by a DAO. The Ref DAO has two roles – council and the community board.

- Council: The Council creates proposals and vote on them. A proposal passes only if the majority of the council confirms them. The Council will be changed once the DAO is fully active.

- Community Board: The Community Board also votes on or rejects a proposal. Mostly, the council will defer to the community board’s decision.

Burrow

Burrow is a non-custodial, decentralized, pool-based interest rates platform. It allows users to supply assets, earn interest, and then borrow against them to unlock liquidity. Burrow is quite similar to other pool-based protocols such as Aave and Compound and runs natively on the NEAR blockchain, with the protocol’s smart contracts written in Rust. The protocol unlocks liquidity for interest-bearing assets, particularly layer-1 staking derivatives like stNEAR (staked NEAR) and stETH (staked ETH). For example, Burrow users can deposit stNEAR as collateral and then borrow NEAR, creating a leveraged staking position. They can also create a self-repaying position by borrowing a stablecoin.

The Burrow ecosystem is powered by the BRRR token, the protocol’s native governance token. Most of the token’s supply will be distributed amongst active community members and Burrow users. The BRRR token has a total supply of 1,000,000,000 BRRR, with 50% allocated to the community, 20% to the DAO Treasury, 20% to the core team, and 10% to strategic investors in the project.

A NEAR-Native Interest Rate Market

Burrow differentiates itself from other platforms that supply assets to platforms by enabling users to utilize interest-bearing assets, which are at the core of the project’s value proposition. Interest-bearing assets are staking derivatives of fungible assets held in investment funds. In crypto, interest-bearing assets are staked derivatives such as stNEAR, stETH, etc. Burrow uses interest-bearing assets of base layers, unlocking yields from the base layer. Staking directly on the base layer provides the extra security of the main chain while also having the highest returns and the most risk-free rates.

Burrow also allows self-paying loans. Self-paying loans are unique because they repay themselves with yields generated from interest-bearing assets. When a user is supplying assets to Burrow, they can lock some of their assets as collateral, and users can borrow from the platform with their interest-bearing assets acting as collateral. Depending on the assets supplied and the interest generated, the loan can be paid off from the interest generated from the interest-bearing assets.

Burrow leverages the Aurora Rainbow Bridge to offer secure interoperability with other Layer-1 chains. Users can then access their assets on other interoperable chains with zero hassles, and supply them to Burrow, unlocking yields or as collateral for a loan. Currently, Burrow supports six assets for supply and borrowing; these are DAI, USDT, USDC, NEAR (wrapped), ETH (wrapped), stNEAR, and stSOL. The protocol also plans on adding bLUNA soon.

By building on NEAR, Burrow can leverage perhaps the most advanced Layer-1 technologies that are found only on NEAR, the Rainbow Bridge and Nightshade. Thanks to Proof-of-Stake and sharding in Nightshade, NEAR has been able to solve scalability issues that have been plaguing Layer-1 chains. This allows Burrow to operate with

- Low Latency

- A fully decentralized chain

- Infinitely scalable chain

- Low user fees

Aurora

Aurora on NEAR enables the execution of Ethereum contracts in a more performant environment. The project can be divided into two primary components: the Aurora Engine, an Ethereum Virtual Machine (EVM), and the Aurora Bridge, which provides trustless transfers of ERC-20 tokens between Aurora and Ethereum. The Ethereum Virtual Machine (EVM) is built on NEAR and allows developers to deploy their applications on an Ethereum-compatible, high-throughput, scalable, and future-safe platform that also features low transaction costs. The project has significant backing from several top VCs, including Electric Capital, Dragonfly Capital, Pantera Capital, Three Arrow capital, and Alameda Research.

Thanks to Aurora, developers can enjoy the familiarity of Ethereum tooling while working with Solidity smart contracts on Aurora. Aurora also uses ETH as its base fee, enabling developers to experience a smooth experience for dApp users. Coupled with the unique features of the NEAR Protocol, Aurora is able to achieve an unprecedented level of scale and transaction speeds in an Ethereum-compatible environment. Aurora is 100% compatible with the Ethereum blockchain and offers a block time of 1 second and confirmation of transactions in 2 seconds.

Key Enhancements

Aurora provides developers with a host of enhancements. Let’s delve a little deeper.

- Aurora offers fees that are up to 1000x lower than Ethereum fees. Transferring an ERC-20 token is lower than $0.01, while on Ethereum, the fee is around $5.40.

- Aurora can easily host thousands of transactions per second. This is a 50x increase compared to Ethereum.

- Aurora offers future-proof growth for ecosystems, with NEAR Protocol’s sharding offering horizontal EVM scaling and asynchronous communication between different Aurora shards.

The platform’s native token, the $AURORA, has a fixed supply of 1 billion. The token has several use cases such as staking, voting, Rainbow Bridge transfer finalization fees, Aurora contract execution fees, and more.

Bastion Protocol

Bastion protocol is an algorithmic, decentralized lending and borrowing protocol. The project is built on Aurora, NEAR’s EVM-Compatible and Gas-less layer. Bastion focuses on tokenomics, composability, UX, and algorithmic risk optimization. Thanks to NEAR, the project is able to achieve capital efficiency, high transaction speeds, low transaction costs, and highly precise liquidations.

Thanks to projects such as Aave and Compound, money markets have become the biggest DeFi primitive on Ethereum. There is also the resounding success of chain-native lending protocols such as the likes of Solend on Solana and Benqi on Avalanche. Bastion has brought the next DeFi primitive to NEAR, enabling users to increase the productivity of their assets through lending or leverage without borrowing.

Bastion gives users the ability to

- Put assets up as collateral

- Supply assets and earn interest

- Leverage long

- Short assets

- Borrow assets

The protocol’s native token is the BSTN token, and it has two primary use cases. The token is at the center of the development of the Bastion Protocol. It allows token holders to vote on key project metrics such as protocol-owned liquidity, fee models, gauges, and staking. It also is key in aligning incentives between different stakeholders on Bastion.

Building on Aurora has allowed Bastion to create an autonomous interest-rate engine that offers significantly greater capital efficiency, quick transactions combined with ultra-low transaction speeds, and precise liquidations.

OIN Finance

OIN is a decentralized stablecoin issuance platform that allows projects to issue their own branded stablecoin. Instead of having to whitelist their collateral on other platforms, OIN will launch a NEAR-collateralized stablecoin to unlock liquidity without selling their NEAR tokens. OIN’s uses cases are – swapping for other mainstream stablecoins, adding leverage, hedging, lending, and a plethora of ecosystem-specific utilities.

Currently, the main product line on OIN is the OINDAO. It allows projects that join to create their own collateralization pool to mint their own brand labelled stablecoins. OIN establishes a quick validation process for each transaction initiated on the blockchain through the Merkle proof system. They do so by putting up small chunks of information leading up to a “root transaction” on the ledger and use it to validate a larger database of information.

Some interesting features of OIN are as follows:

- It is easy and fast to mint stablecoins once the listing project decides the parameters.

- OIN’s smart contracts have all been thoroughly audited.

- Tech support to set up key risk parameters for the smart contracts.

- Tech support to help you swap your branded stablecoin with mainstream stablecoins on Curve and Balancer to unlock the liquidity of your asset.

Skyward Finance

Skyward Finance is a permissionless and open-source launchpad that projects can utilize to launch their tokens without any liquidity. Skyward has potentially one of the best price discovery mechanisms resistant to sybil attacks and bot attacks. The platform looks to enable price discovery and token distribution for projects that are built on NEAR Protocol. It does this by utilizing streaming time-based auctions that can be accessed by the general community in a decentralized manner. These auctions will also be resistant to price manipulation, front running, and sybil attacks. Skyward Finance will issue tokens to the community, allowing them to become a part of the platform and earn revenue.

What Are Some Of The Advantages Of Skyward Finance?

Skyward Finance has several advantages, some of which are as follows.

- Projects can launch their tokens without liquidity.

- Skyward Finance’s price discovery mechanism is resistant to bot and sybil attacks. It also cannot be manipulated.

- Projects can raise funds in any token and can also launch multiple token sales comprising of different tokens.

- Because of Skyward Finance’s immutability to any type of price manipulation, projects and their founders can maximize their capital based on market value.

- Projects do not require the $SKYWARD token to participate in or create a sale.

- Skyward Finance is open-source and permissionless, which means that the smart contracts on the platform are entirely independent.

- Because Skyward Finance runs on NEAR, it is able to take advantage of NEAR’s scalability and cheaper transactions.

Which of the following is a stablecoin issuance platform?

Meta Pool

Meta Pool is a liquid staking protocol that is built on the NEAR Protocol. Individuals can easily stake their NEAR tokens using Meta Pool and its automatic staking strategies. In return, they receive “Staked NEAR” tokens that they can utilize in the DeFi NEARverse. The tokens can also be swapped back to the original NEAR tokens at any point in time.

Meta Pool has become an essential part of NEAR’s DeFi ecosystem as it introduces NEAR’s first liquid staking token, the stNEAR. The stNEAR token can accrue staking rewards and also represent staking positions on NEAR. Meta Pool offers NEAR token holders a platform that is easy to use and generates yields while creating a decentralized network. Meta Pool will run on a DAO on Sputnik V2, NEAR’s native platform to manage Decentralized Autonomous Organizations.

When token holders stake on Meta Pool, they get $META tokens every epoch. Each epoch is 12 hours. These are received on top of the NEAR Protocol rewards, which are 10.2% APY.

Cheddar

Cheddar is creating a loyalty network for NEAR and its ecosystem of decentralized applications. It is accomplishing this through the establishment of strategic partnerships that actively promote using NEAR Protocol when rewarding users. Loyalty networks have been proven to successfully motivate users to perform actions that are beneficial to businesses. Through Cheddar, community tokens can be bootstrapped, enabling applications to increase user loyalty and add new revenue streams using farming mechanisms.

Cheddar is different from other Yield farms as it provides long-term benefits to HODL-ers through powerUPs. It also promotes cross-application use throughout the NEARVerse, enabling users to farm Cheddar through Yield farming, Liquidity pools, or dApps.

How Does Cheddar Benefit The NEAR Protocol

- dApp connectivity – Cheddar creates a common link between apps beyond just individual tokens, thereby creating a loyal ecosystem for dApps on NEAR.

- User engagement – Cheddar creates long-term user engagement through various incentives and building loyalty through strategic partnerships.

- Cross-chain hopping – Cheddar creates cross-chain interconnectivity and keeps users on NEAR active and engaged, ensuring that the Total Locked Value is preserved.

Which of the following is creating a loyalty program on NEAR?

Berry Club

Berry Club allows users to create shared pixel art while also farming token rewards. The Berry Club had started as a DeFi proof of concept but has since grown into an extremely popular community project on the NEAR Protocol. Berry Club makes excellent use of several of NEAR Protocol’s features, such as automatic payments to smart contract creators, which are not found on any other blockchain.

Thanks to NEAR’s unique design, Berry Club and Berry Farm can benefit both users, and smart contract creators, which are paid out in the form of smart contract rewards to both token holders and creators. These benefits arise from the increased use of the application (Berry Club). This type of distribution of rewards is not possible on platforms such as Ethereum, at least not in its current implementation. This is another reason why users and developers should experiment with NEAR.

The bridge between Ethereum and NEAR is called:

Proximity Labs

A research and development firm targeting DeFi on the NEAR ecosystem.

Conclusion

NEAR Protocol already has a very exciting DeFi ecosystem and it is only going to grow further. As things stand, NEAR provides a powerful and efficient alternative to Ethereum.

Top comment

ty for letting me know all this proyects

Test.

nice

Спасибо разработчикам класс