One of the core tenets of a decentralized network is its tokenomics. To help projects better understand the nuances of their tokens, Learn Near Club helped to launch a new hands-on tokenomics playground on NEAR Testnet – LNC|TokenHub. However, before we get into the details, let’s know what tokenomics means.

What Is Tokenomics?

Token was initially just another term for a “cryptocurrency” or “cryptoasset.” However, lately, we have used the term “token” to explain a crypto asset that’s issued on top of a blockchain. The term “tokenomics” is a portmanteau of “token” and “economics,” and it’s a term used to describe, you guessed it, the economics of a token.

When you want to gauge the tokenomics of the network, you need to ask yourself these questions:

- What is the total supply of the tokens, and how many of them are entering the system at once?

- How many tokens will be created in the future?

- How are the tokens being distributed among the users?

- What is the exact role of the token in the network?

- Does the network need a token to function?

Overall, the purpose is to establish a clear link between the platform and the asset.

Elements Defined In Tokenomics

Tokenomics can be broadly differentiated between supply control and utility. Let’s look at each of these elements.

#1 Supply Control

How much of the protocol tokens are actually going to be in circulation. How much of the supply is being controlled by the base contract? In this aspect, we must understand certain terms.

Premining

Basically, how many tokens are already floating around in the ecosystem at the launch time. Usually, tokens are mined out periodically by specialized users called “miners.” However, specific protocols often make a certain % of their overall supply available during launch for token distribution and access to liquidity. However, do note that premining a large number of tokens could lead to centralization concerns.

Token Allocation

How are the tokens allocated to the project team? Do they calculate a vast amount of tokens, leading to centralization issues? How much of the tokens are allocated to the treasury for future protocol development?

Token Vesting

Most projects receive funding from VCs or other investors, who get a token allocation in return for their investment. Unfortunately, more often than not, the VCs tend to dump their allocation immediately to make a quick profit, which inevitably damages the protocol. You can lock up a particular token allocation for a specified time period with token vesting to prevent a massive sell-off.

Token vesting is crucial in inspiring investor confidence since it tells them that the team and investors are serious about the project and not looking for a quick payoff. Vesting is an easy way to lower market manipulations and guarantee value for investment.

Token Burning

Another simple tactic that many projects utilize to control circulating supply is token burning. The idea is simple – periodically remove a certain amount of tokens from circulation permanently. Most projects do this by sending the tokens to a dead wallet. Projects like Ethereum and Binance use token burning to control the supply of their native tokens.

#2 Token Utility

What are the different roles that your tokens can take up? Let’s take a quick look at some of the different roles.

- Tokens can be used for pure utility and payment inside or outside the protocol environment.

- Tokens can be used to stake in the protocol and participate in governance.

- Holding the protocol token is required to access the different apps (DeFi and NFT) within the system.

Playing With Tokenomics

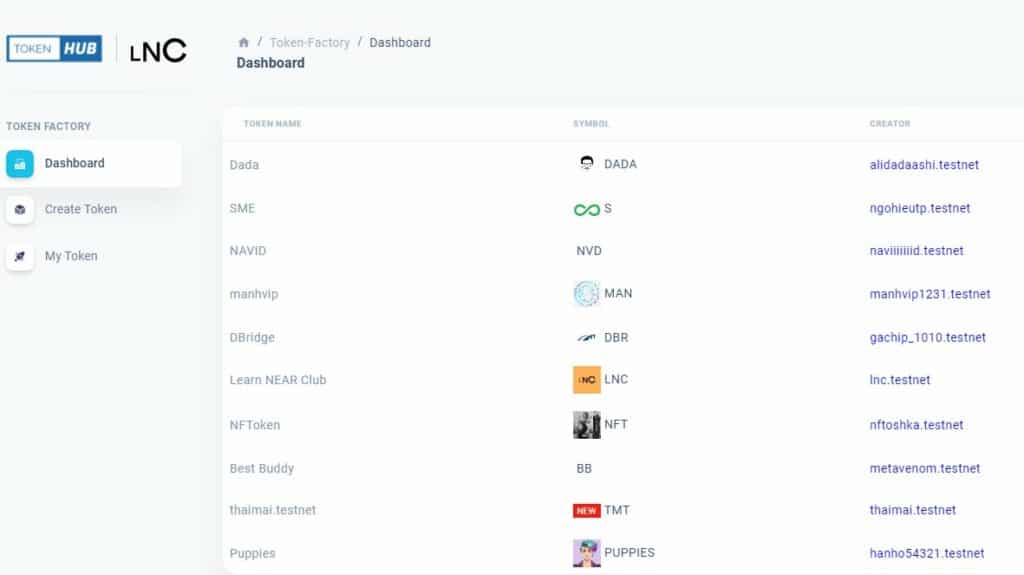

Learn Near’s tokenomics tool lets you map out your token’s different components and play with them on testnet.

These components are:

- Token Name

- Initial Release

- Symbol

- Treasury

- Initial Supply

- Vesting Start Time

- Vesting Duration

- Decimal Points

- Vesting Interval

Playing with these different values will help you understand the supply control of your protocol’s tokenomics. Do you want to experiment with this tool? Check out LNC TokenHub!

Updated: April 14, 2023

Top comment

Good article as a preliminary idea to go deeper

це дійсно корисна інформація, дякую