Meta Pool, Module 1 – First steps on Liquid Staking

Staking and consensus protocol on NEAR Protocol

Before starting, it is recommended that you follow the NEAR Power User course of Learn NEAR Club (LNC) to have basic knowledge about NEAR Protocol.

Every blockchain network requires a method to confirm the new blocks that are being produced.

On the Proof-Of-Stake network this process is made by the validators nodes. To pick these validator nodes is required to lock the tokens assigning these to a validator, this is known as staking. Based on the amount of NEAR tokens staked the set of validators who would participate in the creation of blocks is made.

In order to incentivize token delegators and validators this receives rewards from the fees covered by the protocol. In this way staking is a way to earn more tokens and help to secure the network.

Some of the cons of making this standard staking is that your tokens are locked and you are not able to withdraw them before the unstake period ends. Also you are not able to use your tokens in any way because these are delegated to a validator node. These two limitants are solved when you are doing liquid stake.

Proof of Stake

Investopedia.com defines Proof-of-Stake (PoS) as:

Proof-of-stake is a cryptocurrency consensus mechanism for processing transactions and creating new blocks in a blockchain.

A consensus mechanism is a method for validating entries into a distributed database and keeping the database secure. In the case of cryptocurrency, the database is called a blockchain—so the consensus mechanism secures the blockchain.

With this in mind, NEAR Protocol uses PoS as the system to process all the transactions running on the network by staking NEAR tokens, the native token from this blockchain. On the standard staking, you can pick 1 single validator node and delegate (lock) your tokens to it. This will help the validator to process blocks or chunks and to produce rewards if it is above nakamoto coefficient.

However, delegation in standard staking of PoS systems has a delayed mechanism, e.g. NEAR Protocol, or even the inability to unstake your tokens, like in ethereum. In this case a Liquid Staking solution could support both: Network security in PoS and the ability to use your tokens.

-

Validators nodes

Validators are computers that have received enough tokens (stake) to start confirming transactions on the NEAR network.

In the NEAR Proof-of-Stake network, a decentralized pool of validators process transactions to keep the network secure. In return, these validators receive a reward for doing so. This system also allows delegators – entities that would like to provide security but may not have the hardware to do – to delegate their tokens to validators.

These validators provide computer power to the network in order to compute new blocks and in exchange they receive rewards based on the quantity of blocks or chunks produced.

Read more about NEAR Protocol validators here: https://near.org/about/network/validators/

Proof of Stake works equal to Proof of Work

-

Rewards and NEAR Tokenomics

NEAR is the token used to cover all fees on NEAR Protocol.

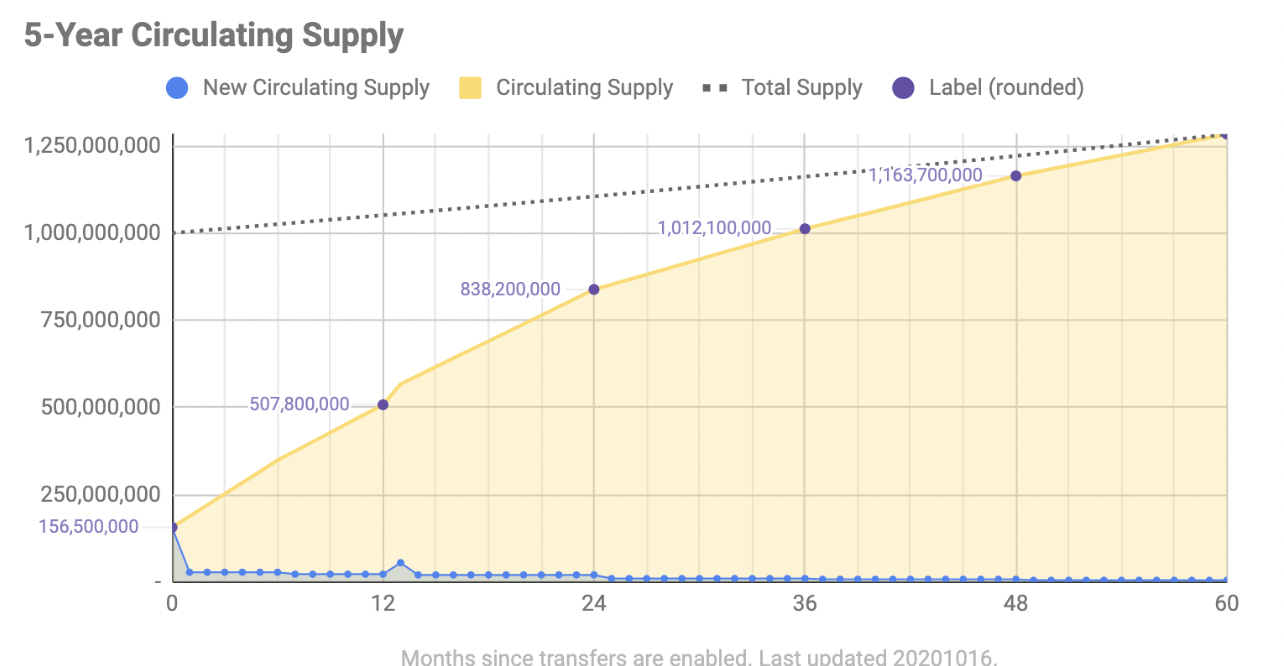

On its tokenomics is indicated a 5-years long and gradual release of tokens.

As mentioned on the paper, 5% of additional supply is issued each year to support the network as epoch rewards, of which 90% goes to validators (4.5% total) and 10% to the protocol treasury (0.5% total).

Extra resources

- Official post by NEAR Foundation: https://near.org/blog/near-token-supply-and-distribution/

- Thread made by NEARWEEK about Liquid Staking: https://twitter.com/NEARWEEK/status/1618257119958175747

Amount of $NEAR tokens that are distributed per year to the validators and delegators.

What is Liquid Staking? Understanding Meta Pool and stNEAR asset

Liquid Staking protocols are at the forefront of the cryptocurrency staking economy, revolutionizing liquidity access in the decentralized finance (DeFi) industry.

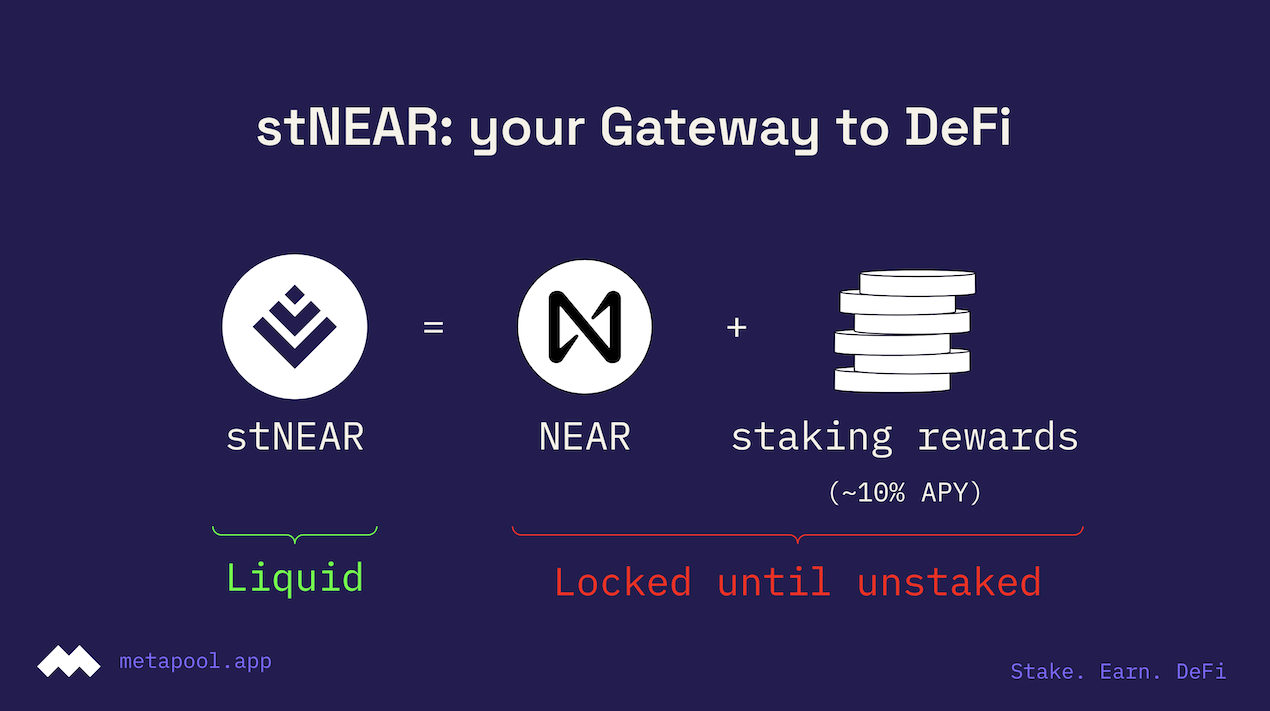

Liquid Staking is an alternative to traditional staking: it allows users to stake any amount of NEAR and to effectively unstake their $NEAR without the requirement of waiting ~48-72hrs (4-6 epochs) before NEAR token holders get their compounded rewards.

One of the benefits of Liquid Staking is the ability to interact and use funds while simultaneously earning rewards. As a result, Liquid Staking protocols provide the foundations for activities such as lending protocols and yield farming activities.

Therefore, users can interact with numerous DeFi platforms earning multiple rewards from one pool of funds.

-

Validators selection criteria

Meta Pool follows the NEAR Foundation strategy to spread the stake among the long tail of high-performance, low-commission, non-concentrated validators, in order to increase decentralization and censorship resistance for NEAR.

We evaluate all validators, in our main product we do not have whitelists, and we publish the formula, the code we use to compute the formula and also the results that will be on-chain. The ethos is to be totally transparent and open to all validators.

We have 5 criteria for selecting validators on the NEAR network, that are in line with our ethos of transparency and fairness:

- Uptime > 95%

- Fees < 10%

- Making sure the validator doesn’t reduce the Nakamoto Coefficient

- Have enough tokens to accomplish the seat price of NEAR Protocol

- Production of rewards during at least 4 consecutive epochs

You can review the list of Meta Pool validators here, you just need to enter meta-pool.near in the account filter.

Does liquid staking on Meta Pool support the network decentralization?

-

Step-by-Step: Making my first liquid stake on Meta Pool

Meta Pool allows NEAR token holders to stake and earn rewards, providing an easy way to unstake with no lockup period.

It does not put all your staked NEAR into just one validator, rather Meta Pool spreads it among many high performant and low fee validators in order that you get the best rewards while at the same time ensuring the network is decentralized and censorship resistant.

- Log in to Meta Pool, by clicking on “Stake Now”

Case 1: NEAR

2. Select one of the options in the dropdown for a token to stake: ETH, AURORA, NEAR, and wNEAR. For this example, we will use NEAR.

3. Click to Connect your wallet and choose your preferred wallet, for this example, we will use MyNearWallet.

4. Select the NEAR wallet you want to use from the dropdown menu and allow the app access to your NEAR wallet: click “Next” and “Connect”.

5. After you’ve logged in, go to the Stake page and Enter the amount that you wish to stake, then click ‘Stake now’.

Note: you always want to leave some NEAR on your wallet to cover transaction costs.

5. Note, the minimum you are allowed to stake is 1 $NEAR

5. You’ll get confirmation after the transaction has been processed by the blockchain and your stake deposit has been successful. This usually only takes a few seconds.

6. Now, you can find your accounts holdings on the Stake page, by clicking on the top button or clicking on the dashboard page.

Note: This panel only displays your assets ($NEAR and stNEAR) from your wallet, if you transfer or sell your stNEAR tokens, they will no longer be displayed in this panel.

On panel you can see the current Meta Pool stats.

Case 2: ETH

- Select one of the options in the dropdown for a token to stake: ETH, AURORA, NEAR, and wNEAR. For this example, we will use Ethereum.

- Click to Connect your wallet to stake and choose your preferred wallet, for this example, we will use MetaMask.

-

Select the ETH wallet you want to use from the dropdown menu and allow the app access to your ETH wallet: click “Next” and “Connect”.

-

Repeat step 5 and 6.

Note, the minimum you are allowed to stake is 0.01 ETH

Step-by-Step: Doing unstake of your NEAR tokens

There are 2 options to unstake in Meta Pool: you can Liquid Unstake (unstake immediately) or do a Traditional Unstake (delayed takes up to 6 days to complete).

Liquid Unstake

You may unstake your stNEAR token immediately by paying a small fee and using the Liquid Unstake feature. Doing this you are actually swapping your stNEAR token for NEAR. This is made possible thanks to Meta Pool liquidity pool.

To Liquid Unstake simply:

- Go to the Fast unstake tab on the navigation menu

- Review the current Liquid Unstake Fee and decide whether you want to proceed.

- Enter the amount of stNEAR you wish to unstake.

- Click ‘Unstake’ and approve the transaction.

- After a few seconds, afte your transaction has been confirmed by the blockchain, you’ll have your unstaked NEAR available on your NEAR wallet.

Note: Meta Pool liquidity fee is in a range from 0.3% to 3%. It varies linearly according to the quantity of liquidity available in Meta Pool Liquidity Pool.

Note, in ETH case the promotional launch period is a great opportunity to earn up to 13% APY, but keep in mind that your tokens will be locked until September 21st, 16:17. After that, you’ll be able to unstake them and withdraw your earnings.

Is stNEAR pegged 1:1 in price with NEAR token.

Traditional Unstake (Delayed)

Traditional Unstake is the default form of unstaking from any validator on the NEAR protocol: due to the design of the network, validators wait 4 – 6 epochs (48-72 hours) before releasing the staked funds back to the user. Delayed unstaking is fee-free for all users.

To withdraw your funds from Meta Pool using Delayed Unstake:

- Go to the ‘Delayed-Unstake’ tab on the navigation menu at the top

- Enter the amount of NEAR you want to unstake and click ‘Unstake‘ button.

Note, the minimum you are allowed to unstake is 1 $stNEAR

- You’ll see a notice informing you of the approx. waiting times. Review and confirm by clicking on Unstake.

- You’ll be prompted to Authorize the transaction on the NEAR wallet. Click Confirm.

- After the delayed unstaking period, the funds will be available to withdraw, click “withdraw” and confirm your transaction, your unstaked NEAR will show up in your NEAR wallet.Note, in ETH case the promotional launch period is a great opportunity to earn up to 13% APY, but keep in mind that your tokens will be locked until September 21st, 16:17. After that, you’ll be able to unstake them and withdraw your earnings.

Delayed unstake affects the network performance due to the extra time required to remove the delegated $NEAR tokens

-

Step-by-step: Being liquidity provider

Liquid Unstaking is only possible thanks to the Liquidity Providers (LP) who supply the protocol with the NEAR required for instant swaps (withdrawals) with stNEAR. Liquidity Providers earn Liquid Unstaking fees.

To add or withdraw $NEAR as a liquidity provider:

- Go to the Liquidity tab on Meta Pool page

- Select whether you want to “Add” or “Remove” liquidity

- Enter the amount $NEAR to add or remove

Note: the minimum required to provide liquidity is 2 $NEAR

4. Confirm and sign the transaction

Now, every time somebody does liquid unstake you will get a fraction of the fees according to your equity on the liquidity pool.

Note, in ETH case this section will be enabled at the end of the promotional APY period.

~10.8% APY is the standard at any time being a liquidity provider

Updated: October 2, 2023

Top comment

Lots of Great things are mentioned here, I've learned a lot, and the express quiz is much better to explore more knowledge!

I am really interested in learning more about MetaPool, liquid staking and liquidity providers.

I am really interested in learning more about MetaPool and liquid staking!