Expected result: a general understanding of the Octopus Network from an end-user perspective

An Octopus is very different from a human. Instead of having a centralized nervous system as humans do, two-thirds of an octopus’ neurons are spread throughout its body and distributed amongst its arms. Those neurons can make decisions on their own without input from the brain — essentially making the octopus a decentralized intelligent life form.

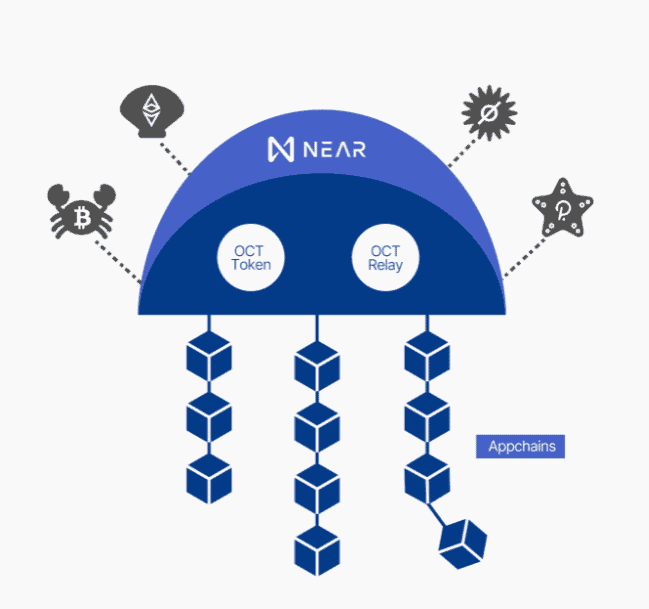

The Octopus Network is a multichain interoperable cryptonetwork that emulates the Octopus. Like the arms of an octopus, each connected application-specific blockchain (appchain) is empowered with its own intelligence and decision-making mechanisms to adapt to ever-changing environments. When connected as a whole, all members benefit from significant network effects and economies of scale — creating an Internet of Blockchains.

Octopus Network is a multichain cryptonetwork for launching and running Web3.0 application-specific blockchains — appchains.

Appchains in the Octopus Network benefit from flexible and cost-effective leased security (LPoS), out-of-the-box multichain interoperability, complete infrastructure, and a ready-to-be-engaged community.

The Octopus Network decreases the cost to launch an appchain from several million dollars to less than one hundred thousand dollars — unleashing the 3rd Innovation Wave of Cryptonetworks.

The Evolution of Web3.0 Applications

Web3.0 hasn’t happened yet. But based on first principles, we’re certain it ultimately will.

Trading always flows to the market with lower transaction costs, just like water always flows downhill.

Web2.0 platforms are owned and run by companies whose goals are directly aligned with maximizing shareholder value. They extract as much profit as they can from the economic activities they coordinate. Cryptonetworks are digital service marketplaces with minimized transaction costs. So Web2.0 platforms simply have no defense against eventually being replaced by cryptonetworks.

Web3 refers to decentralized applications running on blockchains that are owned by the user community rather than profit extracting corporations. Web3.0 aspires to return value to the real creators.

But Web2.0 platforms are fantastic for Internet Users. For a Web3.0 application to supplant a Web2.0 application, it has to be a great Web application in the first place and provide a user experience that is at least as good as its Web2.0 counterpart.

Web3.0 application development typically has to sacrifice user experience because distributed ledger technology involves more complexities and increased costs than Web2.0 — which results in downgraded UX.

But a 3rd Cryptonetwork Innovation Wave is upon us and it’s bringing promising Web3.0 application solutions in with the tide.

The 3rd Cryptonetwork Innovation Wave

Bitcoin is an application-specific blockchain (appchain) — the first and the most successful one.

Inspired by Bitcoin, an assortment of appchains then developed from 2011 to 2015. Some tried to become a better Bitcoin, while the others targeted a variety of use cases other than currency — leaving us with a plethora of dead coins. The commonly agreed-upon reason for this is that the Bitcoin blockchain was purpose-built and unsuitable to address other use cases by being forked or extended. We can call this period the “1st Cryptonetwork Innovation Wave.”

The 2nd Cryptonetwork Innovation Wave was born with Ethereum. Ethereum is a general-purpose public blockchain equipped with a Turing-Complete virtual machine (which could theoretically execute any computation, as long as it remains within the complexity limitation, aka gas limit.) The major EVM programming language, Solidity, with its Javascript-like syntax, is easy to learn and very good at controlling on-chain assets.

Ethereum enabled thousands of developers to build decentralized applications (dApps). Unfortunately, very few could retain many users for an extended period of time until the 2020 DeFi explosion.

But the key challenge facing Ethereum is scalability — and gas fees for running smart contracts have made certain use cases prohibitively expensive. While Ethereum 2.0 aims to target these issues with a sharded blockchain protocol, Ethereum 2.0 is a multiple-year roadmap with unknown execution risks.

However, a 3rd Cryptonetwork Innovation Wave is right around the corner. Blockchain frameworks such as Substrate and Cosmos SDK can provide an unprecedented colossal design space to Web3.0 application developers.

Developers are now able to deliver a fully optimized Web3.0 application by building an appchain.

What is an Appchain?

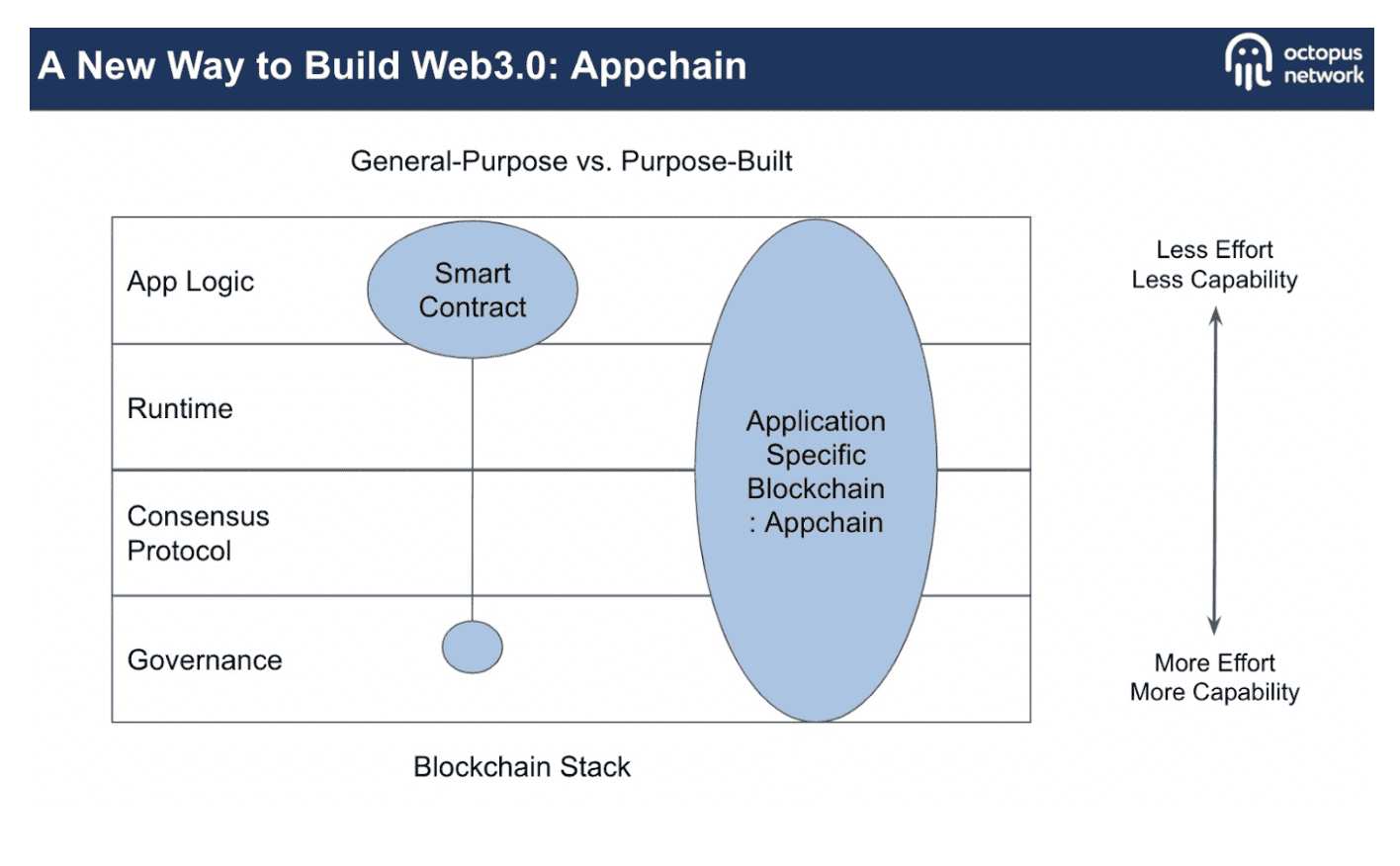

A decentralized application or dApp, is a web application with at least a portion of its backend residing on a blockchain. A dApp’s backend can be implemented in two ways — smart contracts can be hosted on a blockchain platform, or a decentralized application could live on its own dedicated blockchain.

When a dApp has its own blockchain, it’s called an application-specific blockchain, or appchain for short. Unlike dApps, appchains allow developers to customize their application in terms of governance structure, economic design, and even its underlying consensus algorithm.

Appchains also give developers dedicated transaction processing capacity, which means that an application on an appchain doesn’t have to compete with other applications for transaction processing capacity on a network.

To illustrate, while thousands of different applications might share a standard set of configurations on a generic smart contract platform, each appchain in a PoS setting could easily achieve 1K+ TPS throughput and fast finality — and all this transaction processing capacity would be dedicated to just one application.

Unlike smart contracts, appchains can evolve quickly with legitimacy. Each appchain is a self-governed economy with code-defined explicit processes to reach agreements on protocol upgrades. And, thanks to Substrate, the primary function of on-chain governance is ready to use. Any cryptonetwork can mirror the governance process of another by copy-pasted code. Blockchain governance itself could evolve like open-source software.

Still, no one can ignore that smart contracts are great for asset trading use cases, e.g., DeFi. Because smart contracts run based on the same security assumptions, composability between them is the essential recipe for the DeFi explosion.

However, while DeFi’s user experience is not quite as bad as online banking, it still has a lot of room for improvement, especially when considering a more capable layer 1 blockchain than Ethereum — such as NEAR Protocol.

Why did Octopus choose NEAR?

While Substrate and Cosmos SDK have decreased the development cost of appchains to a level at least comparable with smart contracts, appchain bootstrapping is still a technically complex and capital-intensive job for developers.

NEAR Protocol is a sharded proof-of-stake (PoS) blockchain that emphasizes scalability and usability. NEAR is often referred to as a ready-made scalability solution for existing Ethereum dApps, but it is equally capable of handling a suite of other types of decentralized solutions — such as appchains.

Compared to other Layer 1 platforms that can also accommodate appchains, such as Polkadot or Cosmos, NEAR has some key technical and economic advantages.

Compared to Cosmos, launching an appchain on NEAR is easier because validators don’t need to be bootstrapped for each individual appchain.

For example, on Cosmos, each appchain must secure itself with a sufficiently staked, decentralized validator set. So, an appchain’s developers have to first obtain the value recognition of the appchain’s native token in the crypto-asset markets, then bootstrap an active validator community from the ground up.

Compared to Polkadot, NEAR offers appchains a significantly less expensive security lease and doesn’t have a limit on the number of appchains capable of being launched.

A Polkadot parachain must be able to afford the consensus cost of one shard of the network — which could equate to tens of millions of dollars a year.

In a computation system, higher security doesn’t necessarily equate with better security, because a higher level of security always comes with a higher level of cost. So, what a computation system needs is appropriate and adequate security.

In Polkadot, developers don’t get to decide an appropriate and adequate level of security for their parachain. They only have one choice — win a slot in the auction. But even if a parachain wins the auction, it usually overpays for security because a cryptonetwork in its launching phases doesn’t need a multi-billion dollar level of security.

Furthermore, a high-level security cost burden from the onset could plunge a parachain into hyperinflation because it has to promise to issue a massive chunk of native tokens to Crowdloan lenders. At the very least, this economic burden leaves a parachain very little room to incentivize the real value-creators of its protocol — the participants who help build the network effects of the cryptonetwork.

To put it simply, NEAR was chosen by Octopus over Polkadot and Cosmos because it’s simply more cost-effective, scalable, user-friendly, and interoperable with networks like Ethereum than any other existing L1 solution.

We believe that appchains will be the 3rd Innovation Wave of Cryptonetworks that usher us into Web3.0 — and that Octopus Network will make appchains accessible to myriad projects with all kinds of budgets.

What is an appchain?

The Advantages of Leased PoS (LPoS)

What is security in the context of blockchain?

Simply put, security is the level of certainty that the predefined protocols will be applied as most stakeholders expected — whether at the base layer or application layer.

Blockchain security is generally considered a quantifiable property. There can’t be absolute or unlimited security. If a blockchain had absolute security, it must be both unusable and unaffordable.

Compared to a Polkadot parachain’s shared security model, the Octopus Network’s appchain Leased PoS (LPoS) is far more scalable and flexible. Because security leasing is essentially capital leasing or collateral leasing, it scales without physical limitations.

In Polkadot, each parachain will accommodate a certain number of validators in the pool exclusively in any given epoch. The consensus algorithm limits the total size of the pool. (That’s why the total number of parachains is expected to be under 100 with less than 10 parachain slots available this year.)

Octopus’s Leased PoS is much more cost-effective than Polkadot’s. Since Octopus doesn’t have its own blockchain, and the $OCT token is issued and managed by a smart contract, Octopus doesn’t need to pay for consensus costs directly. So, the $OCT inflation rate could be set to zero, which means the base interest rate of the Octopus economic system is zero.

When the base interest rate is zero, a 3%-5% APY is a decent annual return, (which is the range we expect an appchain will pay for their leased security.) In contrast, a Polkadot parachain has to pay 20% or more APY to make itself attractive to Crowdloan $DOT lenders because staking on the Polkadot Relay will give investors a 14% risk-free annual return.

Because LPoS is needs-based security and offers appchains the cost-effective leverage to scale organically, we believe that LPoS is more conducive to the long-term development of appchains than independent PoS. However, we also believe that the right to choose always belongs to any appchain community.

Should any appchain on the Octopus Network choose to stop using LPoS in order to transform into an independent PoS blockchain, Octopus will even provide the tools to support its transformation — Its connection with the Octopus Network would then be downgraded to that of a standard IBC bridge and existing cross-chain assets would not be affected.

Overview of the Octopus Network

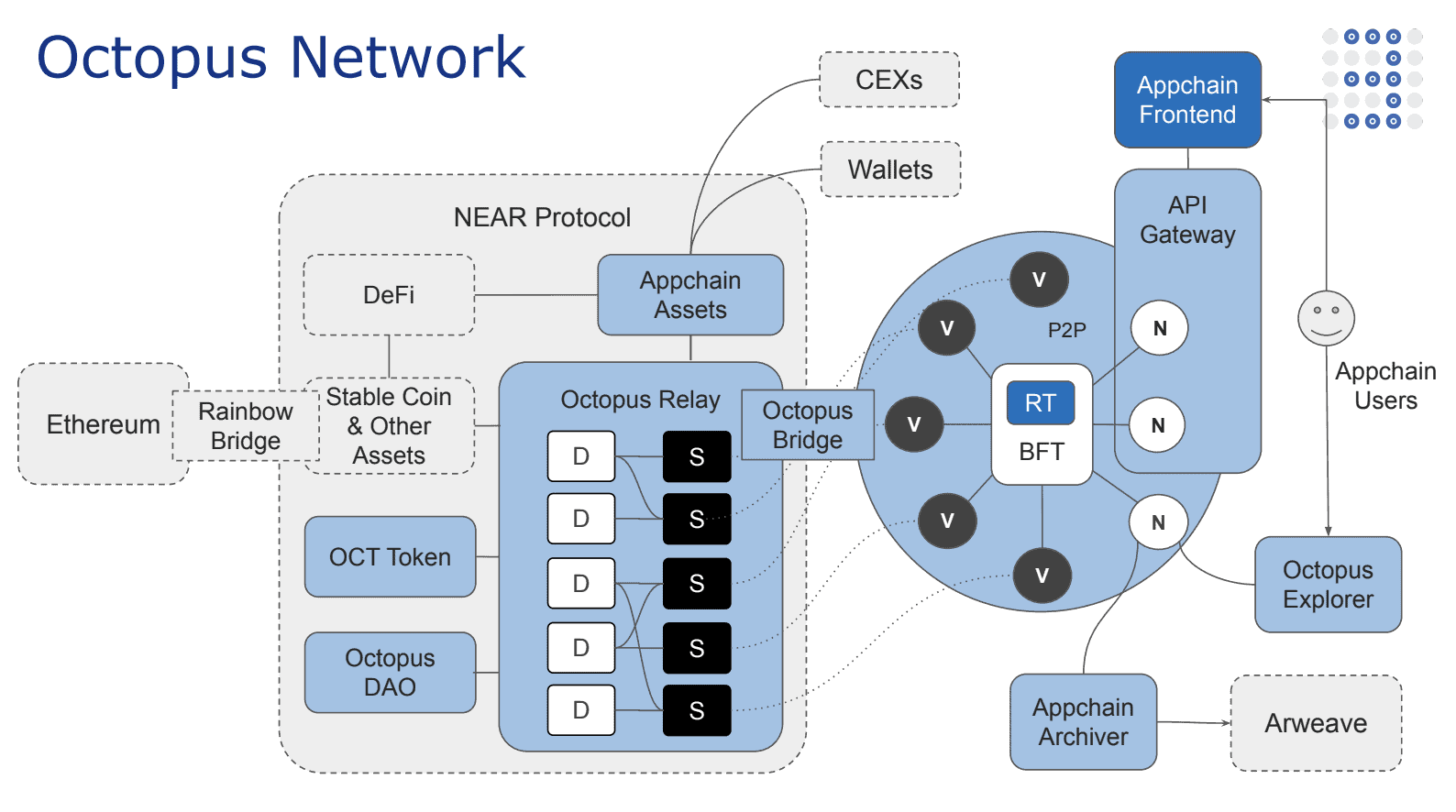

Legend: D-Delegator, S– Staking, V– Validator, RT – Runtime, N– Node

The Octopus Relay is situated at the core of the Octopus Network. The Octopus Relay is a set of smart contracts running on the NEAR blockchain (aka mainchain) that implements the security leasing market.

Octopus appchains sit on the demand side of the market. Octopus appchains lease security from $OCT holders by paying rent in their native tokens. Each appchain can choose its own economic model, including how many native tokens it’s willing to pay Validators for security.

Octopus Validators and Delegators sit on the supply side of the security leasing market.

Octopus Validators stake $OCT tokens to validate a particular appchain and set up a node to run that appchain’s protocol. In return, Validators are eligible to receive the respective native token of the appchain they are validating.

Octopus Delegators can delegate their $OCT to Validators for a share in the staking rewards of an appchain’s native token. Staking rewards are distributed to Delegators directly after Validators collect a unified commission.

If Validators misbehave (e.g. go offline, attack the network, or run modified software), they (and their Delegators) are slashed by losing a percentage of their staked $OCT. All punishments are applied to Delegators proportionally when their Validators get slashed. In this way, staking acts as a disincentive for malicious behavior.

Because $OCT holders are responsible for deciding which appchain they’d like to stake on, the Octopus Network works as a free market where appchains can lease the level of security they need at market price any time.

The Octopus Network also has a series of tools for security providers, such as appchain validator node automatic deployment and management tools, network economic views, and statistical analysis tools.

The Octopus Network LPoS market enables any developer, project, or entrepreneur to quickly, efficiently, and affordably create their own appchain on NEAR.

But the Octopus Network also supports appchains in many other ways including providing crosschain interoperability, built-in infrastructure, and a ready-to-be-engaged community.

What are the advantages of LPoS?

Interoperability

It’s less controversial now to assert that all public blockchains and multichain networks will eventually be interconnected — forming the Internet of Blockchains. The Octopus Network is specifically designed to be a part of this.

The Octopus team (previously known as Cdot) has been working on universal blockchain interoperability protocol IBC and cross-chain integration for more than two years.

The Octopus Relay enables appchains’ interoperability with NEAR protocol and Ethereum via the Rainbow Bridge. Additionally, appchains can utilize an out-of-box IBC pallet to connect with any IBC enabled blockchains directly.

Any asset issued on Ethereum, NEAR, or any IBC enabled blockchain can be transferred into and utilized by Octopus appchains trustlessly. Conversely, any assets issued on appchains can be transferred trustlessly out to Ethereum, NEAR, and any IBC enabled blockchain.

Based on seamless interoperability between the Octopus Network and NEAR, the variety of crypto assets issued on Octopus appchains will also contribute to the prosperity of NEAR’s DeFi ecosystem.

Infrastructure

The Octopus Network provides a complete set of infrastructure for appchains — including API Gateway, Blockchain Explorer, Archive Gateway, etc.

The Octopus Bridge will deploy a NEP-141 wrapper contract on NEAR for each appchain native token. Then wallets and exchanges can integrate standard wrapper tokens rather than having to integrate with each appchain individually.

So, appchain teams only need to focus on Substrate runtime and front-end development while the Octopus Network handles all the other technical necessities.

Community

A cryptonetwork is owned by its community. This is the essence of decentralization and the fundamental difference from Web2.0 platforms.

The Octopus Network acts as a meta-community for nurturing hundreds of Web3.0 application communities. Web3.0 application developers and appchain founders can display the merits of their cryptonetwork to attract a variety of supporters — such as investors, Validators, Delegators, and protocol participants.

Users interested in different Web3.0 applications will pay attention to their favorite applications through events such as the Octopus appchain launchings. In this way, Octopus is a community-base for appchains to support their own journey of building active communities around them.

The Octopus Network also provides great forkability to all its appchains, making it meaningless for any type of tycoon or tyrant to takeover an appchain without agreement from the community — keeping it decentralized. Octopus will serve all its appchains with forkability by archiving the appchain block history to Arweave — a decentralized permanent storage protocol.

Based on the archived block history, every appchain can be forked at any height to become a new appchain if its community supports the fork. And any appchain core team is replaceable if it loses the trust of its community. This is how user awareness ensures decentralization.

What is the Octopus Accelerator Program?

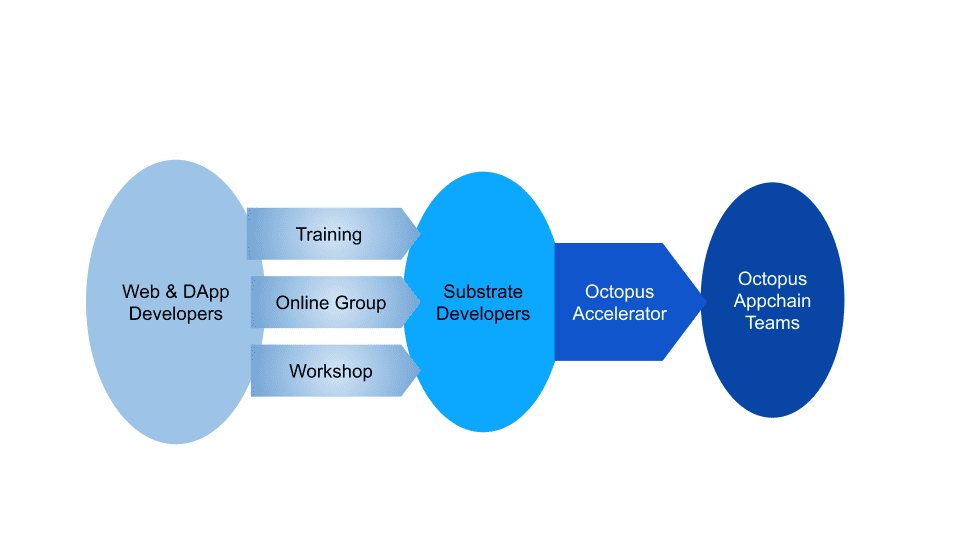

The Octopus team is well aware that the blockchain space is still just a sliver of the entire internet industry. And within the blockchain space, Solidity smart contract developers are much more prolific than Substrate developers.

In order to find and attract outstanding appchain projects, the first task is to transform Web and Solidity developers into Substrate developers. In this regard, the Octopus team is very experienced.

The Octopus Team has successfully built IBC for Substrate and has also offered Substrate online training courses in China with other Substrate enthusiasts. These courses trained the first batch of Substrate developers in China, initializing the genesis of the Chinese Substrate Community. Octopus developers are also organizers of the Rust community in China (including RustCon).

To date, many members of the Octopus team have served as teaching assistants for the course, which is now an official course funded by Parity, Inc. Based on these experiences, we are negotiating with partners worldwide, including the NEAR education team, to provide similar training courses globally.

But Octopus recognizes that qualified Substrate developers aren’t everything that successful Web3.0 application projects require. This is why we’re launching the Octopus Accelerator Program — a collection of open and composable courses and seminars available to both Substrate developers and Web3.0 teams worldwide.

Each quarter, the Octopus Accelerator Program will hold a batch of courses lasting ten weeks. During each course period, subjects offered will include such topics as Token Economics, Web3.0 Product Design, Community Building, Blockchain Governance, Crypto Regulation, and Crypto Project Fundraising. Invited experts will participate in seminars, provide videos on specific topics, and be available as mentors.

At the end of each batch of courses, the Octopus Foundation will hold a Demo Day event to select the top five appchain projects and provide them with up to $250k in total rewards per quarter.

In this way, the Octopus Foundation will directly fund 20 appchain projects through the Octopus Accelerator Program each year, granting them more $1 mil in total.

Which is true about the Octopus Development Team?

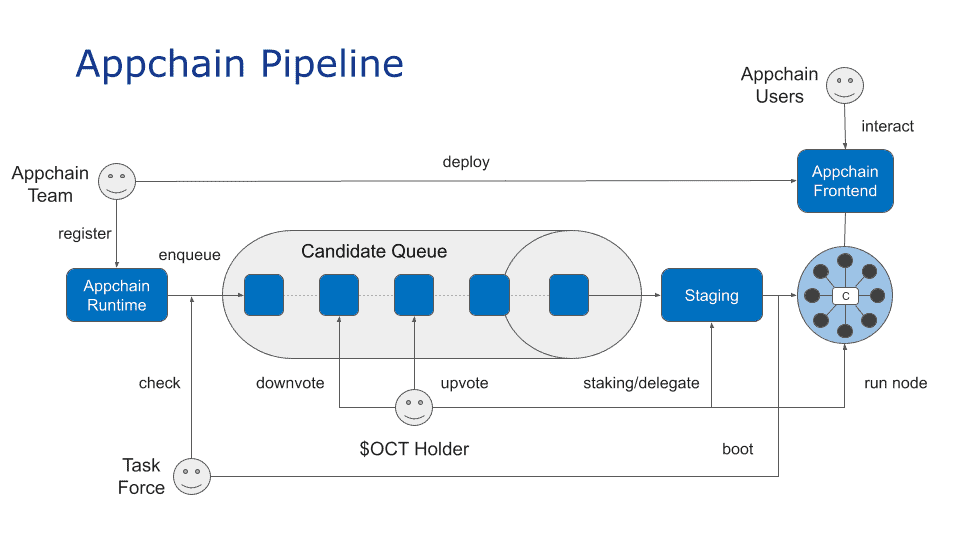

How Appchains Go Live in Octopus

The architectural design of the Octopus Network — together with the processing power of the NEAR Protocol — makes it easy to host hundreds of appchains. The process of appchain selection is a part of the Octopus protocol and the decision-making power belongs to the Octopus Community.

Besides being appchain Validators and Delegators, $OCT token holders have the right to select the best appchain projects by upvoting or downvoting in an on-chain candidate queue.

Substrate-based chains can become Octopus appchains by successfully completing the following stages:

- Registration

- Audit

- Voting

- Staging

- Booting

Registration Stage

Any Substrate-based chain can apply to become an Octopus appchain. Registration requires a white paper or spec and a runtime release that has been internally tested and audited. To prevent abuse, the registration requires a small deposit of $OCT.

Audit Stage

After the appchain is registered, members of the community task force will audit it. The purpose of the audit is to ensure that the appchain has no known security vulnerabilities and that its application logic is consistent with its white paper or spec.

Appchain auditing itself is currently an unmet need in the blockchain space. Only a few companies in the industry have the relevant experience and the services they provide are expensive.

Auditing performed by the Octopus Network not only greatly reduces the cost of an appchain launch for its founders, but also contributes to the accumulation of relevant knowledge and professional capabilities.

Voting Stage

Once an appchain has passed the auditing phase, it enters the candidate queue where it will be upvoted or downvoted by $OCT holders.

In a rolling period that lasts one to two weeks, the appchain that ranks first with the most number of upvotes minus downvotes in the queue will enter the staging state as the most supported appchain by the Octopus Community.

Staging Stage

In the staging stage, $OCT holders can stake or delegate on the appchain.

When the staging period ends, if the appchain has attracted enough staking beyond the security bottom line, it will enter the booting state.

Booting Stage

In the booting stage, task force members will run 4 bootstrapping nodes to start the appchain. Then Validators should run their nodes to join the appchain consensus.

The Octopus Network will also run a full node cluster for each appchain and provide API access services to the appchain’s front-end. Appchain developers then just need to update the front-end configuration, and the appchain is ready for end-users.

Appchain Rewards

Octopus recognizes that appchain projects are the value creators of the network. While other multichain networks charge admission for appchains, Octopus considers appchain teams to be the most critical part of the community and is very happy to share the benefits of network effect expansion with them.

Therefore, the first 100 launched Octopus appchains will be directly rewarded with 100k $OCT.

In addition, the foundation has decided to provide an additional 1M $OCT rewards for the first ten appchains to recognize them as founding appchains.

What is the $OCT token?

$OCT, the native token of the Octopus Network, is a fungible, non-inflationary token with three primary utilities:

- Collateral to guarantee appchain security

- Governance

- Endorsing appchain candidates by upvoting them in the candidate queue

Security Collateral

$OCT plays a key role in the Octopus Network through appchain staking. Holders stake their $OCT to provide security to the appchains they believe in to earn rewards in the respective appchains’ native tokens.

Staking $OCT also acts as a disincentive for malicious participants who would be penalized by having their $OCT slashed, which is the source of leased security for Octopus appchains.

When Octopus runs in its full capacity, 30-50 appchains will be launched in the network annually.

If the long-term equilibrium rate of return of appchain staking is 5% per annum, newly launched appchains alone would bring in about $400M in collateral demands each year.

Governance

The second function of $OCT is to entitle holders to control the governance of the network, (more specifically, the Octopus Relay where all economic rules apply,) by forming the Octopus DAO.

The Octopus DAO Council has a maximum of 100 members, but it’s most likely to grow from a few members in the beginning to a few dozen when stable.

Each Council member’s governance power is valuable but still dispersed enough to avoid collusion.

In our opinion, in most cases, a token’s governance value can not be decoupled from its utility value. A sound and widely participated-in governance will give token holders more stable value expectations and suppress extreme fluctuations in the token price, thereby reducing the implicit option cost of appchain staking.

Appchain Voting

The third function of $OCT via $OCT holders is the selection of which appchains will go on to live in the network by upvoting or downvoting on appchain candidates.

Appchain teams will need to convince the Octopus community that their Web3.0 application is meaningful and will create continuous value streams for investors who stake $OCT on their appchains.

$OCT holders will select which appchains they support carefully, for there is an opportunity cost of missing those which could be more valuable.

Conclusion

We named the Octopus Network after the most fiercely intelligent marine benthic creature. From an evolutionary perspective, the octopus, which consists of some 300 species, is an incredibly successful organism. It’s been around for 155 million years, lives in every ocean, and its many species have successfully adapted to a wide range of diverse marine habitats.

We fully expect the Octopus Network to deliver decentralized applications for every online industry that the Web2.0 traditional middleman has heretofore controlled — and return value to the real creators.

In the Octopus Network, we can build Web3.0 applications with great user experience by leveraging appchain technology — whether in gaming, NFTs, DAO, advertising, the creators’ economy (video, audio, graphics, text), prediction markets, the token curated registry (TCR), and more.

The 3rd Cryptonetwork Innovation Wave is currently being ushered in on the back of the versatile Octopus bringing with it the potential for a tsunami of Web3.0 decentralized innovation — limited only by the imagination.

Updated: August 22, 2022

Octopus Network Let's gooo

Innovation

I do not know but I love oct. I trust it. go ahead

I love octopus, I am an octopus man. this doc is good for understanding how octopus work

Amazing!